- Home

- How Can I Help?

- Child Care Tax Credit

- Home

- How Can I Help?

- Child Care Tax Credit

Child Care Tax Credit

Leverage your Gift with the Colorado Child Care Contribution Tax Credit

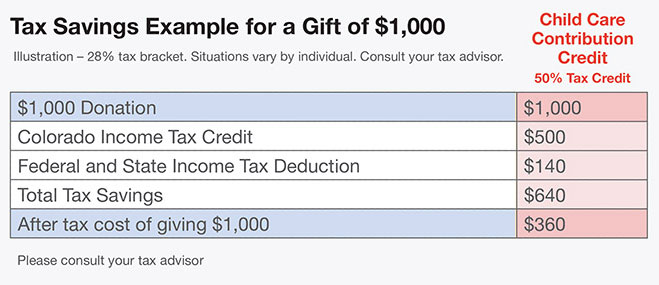

When you give to Ability Connection Colorado and designate your gift in support of our Creative Options program, you can take advantage of tax credit programs that enable you to give more, receive something in return and possibly multiply your gift in the process!

When you or your business contributes funds to promote and develop child care activities, you can get a 50% Colorado Tax Credit, in addition to your regular state and federal contribution deductions. A contribution to Ability Connection Colorado’s CREATIVE OPTIONS for Early Childhood Education programs qualifies for the tax credit. Please consult with your tax advisor for more information.

If you need your Child Care Contribution Tax Credit Certification (DR 1317) for a gift made to Creative Options, please contact Terri Armstrong at 303-941-4553 or tarmstrong@abilityconnectioncolorado.org

Click here to read more about the Child Care Contribution Tax Credit PDF.

As with all charitable contributions, please consult your tax specialist or accountant.